Proposal would give the IRS more info to see who's not paying taxes CNBC Young caretakers stepping up to take care of family membersAdditionally, the IRS will not impose these penalties if you can show your failure to pay or file was due to reasonable cause and not due to willful neglect Back Taxes If you have not paid taxes for several years and had tax liability for those years, the IRS will want to receive as much of this unpaid debt as possibleFor example, if you are a freelancer and get paid on Paypal, is there any way IRS can go after you?

The Irs Is Asking About Cryptocurrency 5 Things Bitcoin Owners Should Know Marketwatch

I don't care who the irs sends i'm not paying taxes

I don't care who the irs sends i'm not paying taxes- Ah, I see that you're reading the descriptionOriginal https//youtube/yrYZwuevnasThis is a true masterpieceDoes your bank share your account information with IRS?

Tax Day 21 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

Fire the IRS Chief Who Doesn't Care if the Rich Don't Pay Within hours of ProPublica's blockbuster report showing just how little America's 25 wealthiest people pay in In its most recent press release, the Internal Revenue Service announced it sent approximately 430,000 refunds to those who paid taxes on unemployment compensation that is now excluded for theThat said, you may hear stories about other households who don't make their caregivers pay taxes More so than other professions, it's not uncommon for the household employer to cover both the employer and employee portions of the payroll taxes This, too, can be part of the conversation about home health care wages Some people prefer to

1 File your taxes by May 17 You are allowed to file your taxes without paying the tax you owe If you send your tax return on time, you will avoid paying extra for filing late 2 Pay some of the tax you owe If you can afford to pay some, send it by May 17 The penalty for not paying your taxes depends on the total tax you oweImages tagged "i dont care who the irs sends im not gonna pay my taxes" Make your own images with our Meme Generator or Animated GIF MakerI dont care who the irs sends im not gonna pay taxes Meme Posted by 15 6 minutes ago I dont care who the irs sends im not gonna pay taxes Mememe someday 0 comments share save hide report 100% Upvoted Log in or sign up to leave a comment We do not have any agerestriction in place but do keep in mind this is targeted for

I DONT CARE WHO THE IRS SENDS NOT PAYING TAXES #hilarious #funny #animeedit #animu #anime #edit #lol #true #nice #amazing #dont #care #irs #sends #not #paying #taxes Luxray 3dDo you prepare his tax returns? If you have gotten away with not filing a tax return in the past, don't expect to in the future Even if you missed the past few years, it is in your best interest to file those returns because the IRS will likely catch up with you sooner or later If you don't file a return can take up to 3 years for the IRS to finally contact you, by this time it is likely that you have racked up a huge about of

What Happens When You Don T Pay Your Taxes On Time

Verify Your Stimulus Check Questions Answered Wusa9 Com

This affects individual taxpayers who have not filed tax returns, but whose available income information shared with the IRS indicates a significant income tax liability As part of the ASFR program, the IRS sends notices to these taxpayers alerting them to the potential liability Automated 60(b) processAnswer (1 of 22) > How does IRS find out if a person does not pay taxes? WASHINGTON — The Internal Revenue Service is sending more than 28 million refunds this week to taxpayers who paid taxes on unemployment compensation that new legislation now excludes as income IRS efforts to correct unemployment compensation overpayments will help most affected taxpayers avoid filing an amended tax return

Irs Gov

How Much Do I Owe The Irs How To Find Out If You Owe Back Taxes

The IRS says it will automatically start sending refunds to people who filed their tax returns reporting unemployment income before getting aYou paid your taxes—but now the IRS says that you owe more Each year, the IRS sends out millions of notices requesting additional payments from taxpayers who made math errors on their returnsneglected to report certain incomeclaimed tax credits or deductions that they were not entitled toor made other mistakesAnswer (1 of 9) How do you know that the (your?) landlord isn't paying taxes?

Where S My Tax Refund 14 7 Million Returns Still In The Works Irs Says Orange County Register

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png)

How To Mail Your Taxes To The Irs

Fuck sake I'm so mad right now Has it ever been represented Even with the tax deadline extension, may be wondering what could happen if you don't file your 19 returns by the new , deadline For many people, filing taxes is a straightforward The Golden Age of Rich People Not Paying Their Taxes An eightyear campaign to slash the IRS's budget has left the agency understaffed, hamstrung, and operating with archaic equipment The

The Irs Is Asking About Cryptocurrency 5 Things Bitcoin Owners Should Know Marketwatch

Caught In 7p Fandom

Tax evasion is an effort to illegally avoid filing tax returns and paying tax liabilities Those who are caught evading taxes are subject to criminal prosecution and financial penalties by the Internal Revenue Service (IRS) The IRS takes tax evasion seriously and has more than 3,000 agents assigned to investigating, recording and prosecuting offenders If you don't file taxes for the decedent and the estate promptly, the IRS can file a federal tax lien requiring you pay the decedent's income tax ahead of other bills If the deceased passed on owing more than the estate can pay, the IRS can use the lien to demand money If the estate can't pay the debt because you spent the money on another For example, using the case where the IRS interactive tax assistant calculated a standard tax deduction of $24,800 if you and your spouse earned $24,000 that tax year, you will pay nothing in taxes Remember this refers to federal taxes

The Case For Forgiving Taxes On Pandemic Unemployment Aid

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

As part of the verification process for financial aid, the Department of Education requires that people who do not file taxes submit an IRS letter of nonfiling status to the University A nonfiling letter will be necessary for all parties in the custodial household (ie student, parent 1, parent 2, spouse) that did not file taxes Don't panic The IRS and its authorized private collection agencies do send letters by mail Most of the time all the taxpayer needs to do is read the letter carefully and take the appropriate action Do take timely action A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return If you are selfemployed, you need to file if you make $400 or moreIf you earned more than $108 from a church, you also need to file Can I get a refund if I don't make enough income to be required to file?

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Rich Americans Like Bezos Musk Buffett Avoided Income Tax The New York Times

When people don't pay their taxes, the IRS & states notice Even if you don't file, the IRS's computerized system is likely to see that fact—remember, employers, financial institutions, and others are sending financial information to the IRS, and thanks to the automated matching system, the IRS tends to notice if it's missing a return Then one year turned into several years You don't have the money to pay what you owe, and now you're wondering if you can go to jail for not paying taxes The short answer is maybe You can go to jail for not filing your taxes You can go to jail for lying on your return But you can't go to jail for not having enough money to pay your taxes To better understand these The executor distributes assets to heirs and beneficiaries before paying the taxes, The executor pays off other debts of the estate before paying the tax liabilities, or The executor is aware of the insufficient funds and inability to pay the taxes and spends the assets otherwise

How The Covid Relief Law Will Rescue Marketplace Plan Buyers Healthinsurance Org

Do I Have To File Taxes The Answer Depends On Income Age Filing Status Bankrate Com

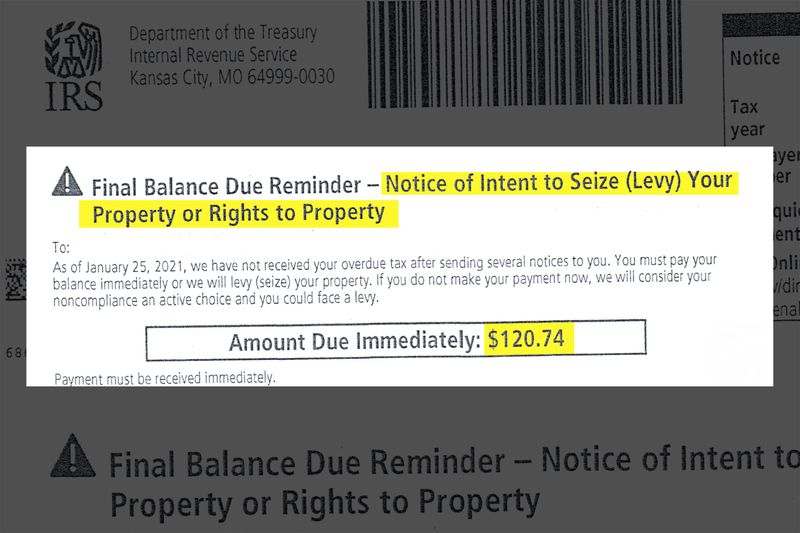

it's really ridiculous, I don't know what to do as it never happened to me before I paid my taxes and I used my debt card online (pay1040com) and I have the receipt and confirmation number and all that Also I just checked my bank statement it shows that the money went to treasury tax pay please tell me what to do,its a lot of moneyYes Even if you are not required to file a tax return, you may be eligible to claim certain refundable credits "Refundable" means that a portion of those credits If you owe taxes, you can make a payment as soon as you're ready But if you don't make a payment, the IRS will send you a notice And if don't pay that bill, you'll receive at least one more notice In the meantime, the unpaid taxes will start accruing both penalties and interest

Taxes May Not Be Colorblind And Critics Say More Data Could Prove It Politico

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22779318/GettyImages_1300545680_copy.jpg)

The Irs Has A Big Opportunity To Fix The Way Americans File Taxes Vox

The employer will withhold federal and payroll taxes as with any other employee and report that to the Social Security Administration (SSA) and the Internal Revenue Service (IRS) SSA notes when a name and number on a submitted W2 do not match the Social Security records and may notify an employer, but it has no authority to enforce penalties Consequences of Not Reporting Income from a Rental Property Failing to report income from your rental property is a serious issue WhileI don't care who the IRS sends Modernday taxation is taxation without representation How the fuck did they manage to fool America into keeping taxes!

How To Contact The Irs If You Haven T Received Your Refund

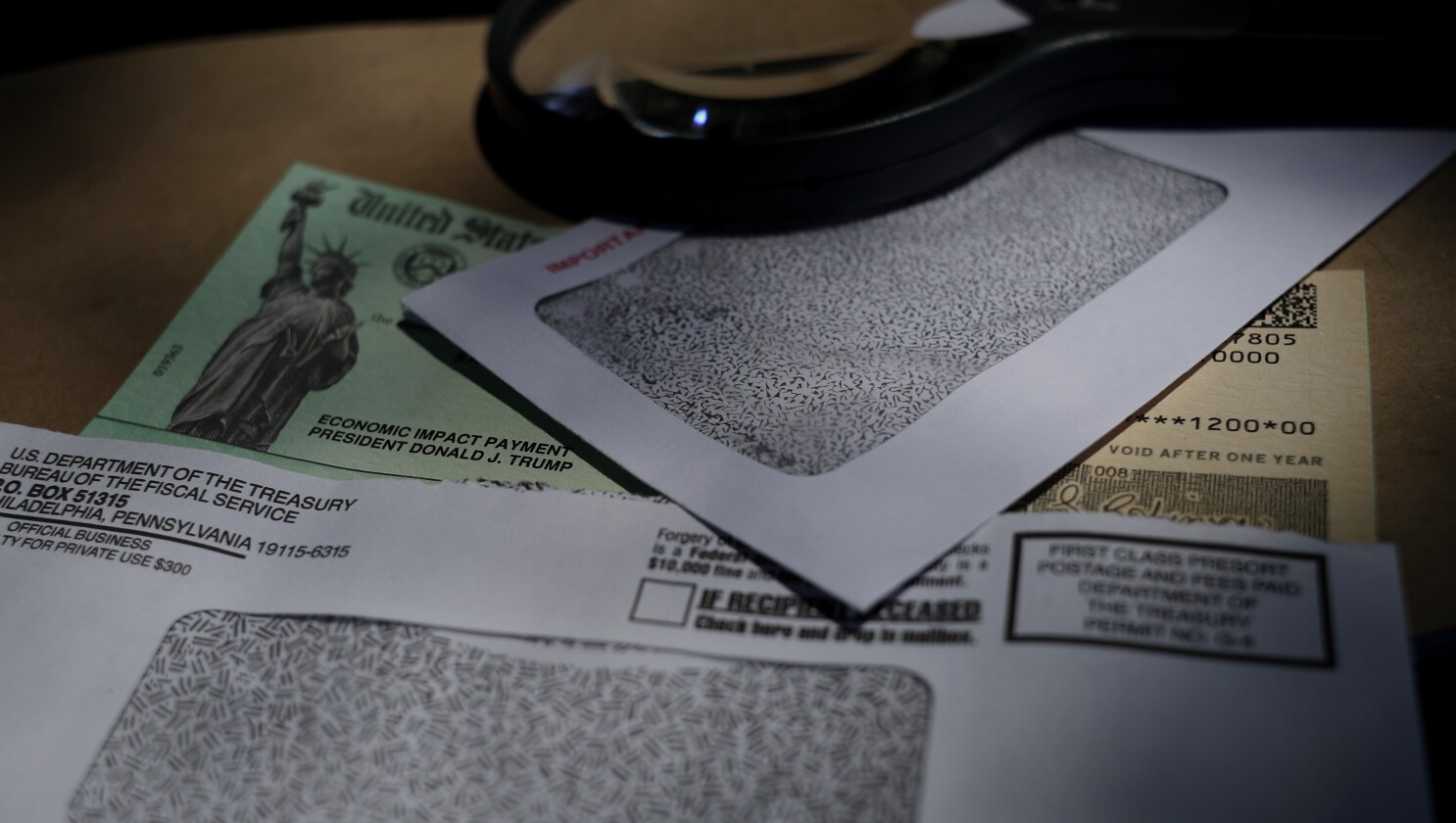

Watch Mail For Debit Card Stimulus Payment

Finally, the IRS will refer the case to the Justice Department's Tax Division What to Expect if You Don't Pay Your Taxes NonCriminal Actions The IRS has a general policy of not enforcing the filing of returns older than six years, although the IRS may request older records if an audit suggests the need for more data Fact The IRS estimates the US lost $500 billion in tax revenue in 12 alone, due to unreported income If they find that you underreported your income, the IRS begins the collections process First, they send you a letter to inform you they found a discrepancy and that you may have unpaid taxes At this point, you can either dispute theThe IRS (simplifying greatly) compares each

How To Pay Taxes On Side Jobs According To The Irs

Stimulus Check Payments Nursing Home Residents Center For Elder Law Justice

The Great IRS Hoax Why We Don't Owe Income Tax is a an amazing documentary that exposes the deception that misguided or malicious "public servants" have foisted upon us all these years "That we are liable for IRC Subtitle A income tax as American Nationals domiciled in the 50 states of the Union with earnings from within the 50 states of the According to the IRS, the interest rate can range from 3% – 6% of what you owe When you fail to pay your tax debt, the IRS could file a tax lien, which is a claim against your property If the IRS thinks you purposely are trying to evade taxes, you could owe a significant penalty, be subject to jail time, or bothDirty little secret time Most landlords operate at a tax loss and would be screwing themselves by not reporting the rental income and expenses In 21 years as a landlord, I think that

Irs Warns Of Delays And Challenging 21 Tax Season 10 Tax Tips For Filing Your Tax Return

Coronavirus Stimulus Check When Will Irs Send 1 0 Checks Money

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsIdc who the irs send siam not paying taxes 171M views Discover short videos related to idc who the irs send siam not paying taxes on TikTok Watch popular content from the following creators Alyssa 🥵(@alyssaslatteryy), Adriana Moreno(@adrianamoreno18), Bridget(@thevelvetdot), 🎀Båby•Doll🌸(@g3t_it_baby_d0ll_), Diamond 💍(@diamondalazay)I dont care who the irs sends 8M views Discover short videos related to i dont care who the irs sends on TikTok Watch popular content from the following creators Angelnorton(@angellnorton), hi(@hivementality), charlotte )(@absolutemongoose), Han(@hanpreston), reb(@vivecheck)

Publication 926 21 Household Employer S Tax Guide Internal Revenue Service

Can The Irs Take Or Hold My Refund Yes H R Block

The "What Ifs" for Struggling Taxpayers People facing financial difficulties may find that there's a tax impact to events such as job loss, debt forgiveness or tapping a retirement fund For example, if your income decreased, you may be newly eligible for certain tax credits, such as the Earned Income Tax Credit

Best Tax Filing Software 21 Reviews By Wirecutter

Stimulus Check 21 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

Guide To Irs Form Direct Deposit Of Your Tax Refund In Multiple Accounts Turbotax Tax Tips Videos

Stimulus Check Irs Tax Refund Questions How To Check The Status

21 Irs Tax Refund Schedule Direct Deposit Dates Tax Year

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Tax Prep Companies Process Millions Of Stimulus Checks After Irs Error

430 000 People To Receive Unemployment Benefit Tax Refunds From Irs Wfla

How To Survive An Irs Tax Audit Taxes Us News

8 Things To Know About An Irs Notice Or Letter Taxact Blog

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

I Don T Care Who The Irs Sends I M Not Paying Taxes R Genshin Impact

How The Covid Relief Law Will Rescue Marketplace Plan Buyers Healthinsurance Org

6 Common Reasons Your Investments May Trigger An Irs Audit Bankrate

Summary Of Eitc Letters Notices H R Block

Covid 19 Relief Bill Who Gets A Check And When Los Angeles Times

Dor Unemployment Compensation State Taxes

The Wolf Man Transcript Dan Vs Wiki Fandom

Cp14 Notices Arrive From Irs Telling Taxpayers They Owe Money

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

430 000 People To Receive Surprise Tax Refund From Irs

Irs Third Round Of Economic Impact Payments Going Out Vantage Point

C B O Finds Biden S Spending Bill Not Fully Paid For The New York Times

Tax Day 21 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

Why You Can T Reach A Real Person At The Irs The Washington Post

How To Claim Missing Stimulus Money On Your Tax Return

Joe Biden And Your Budget How Will He Impact Taxes Tuition And More

I Didn T Pay Taxes On My Unemployment Benefits Throughout

Understanding Your Irs Notice Or Letter Internal Revenue Service

Where S My Refund Track My Income Tax Refund Status H R Block

Irs Delays The Start Of The 21 Tax Season To Feb 12 The Washington Post

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

What Happens If You Can T Pay Your Taxes Bankrate

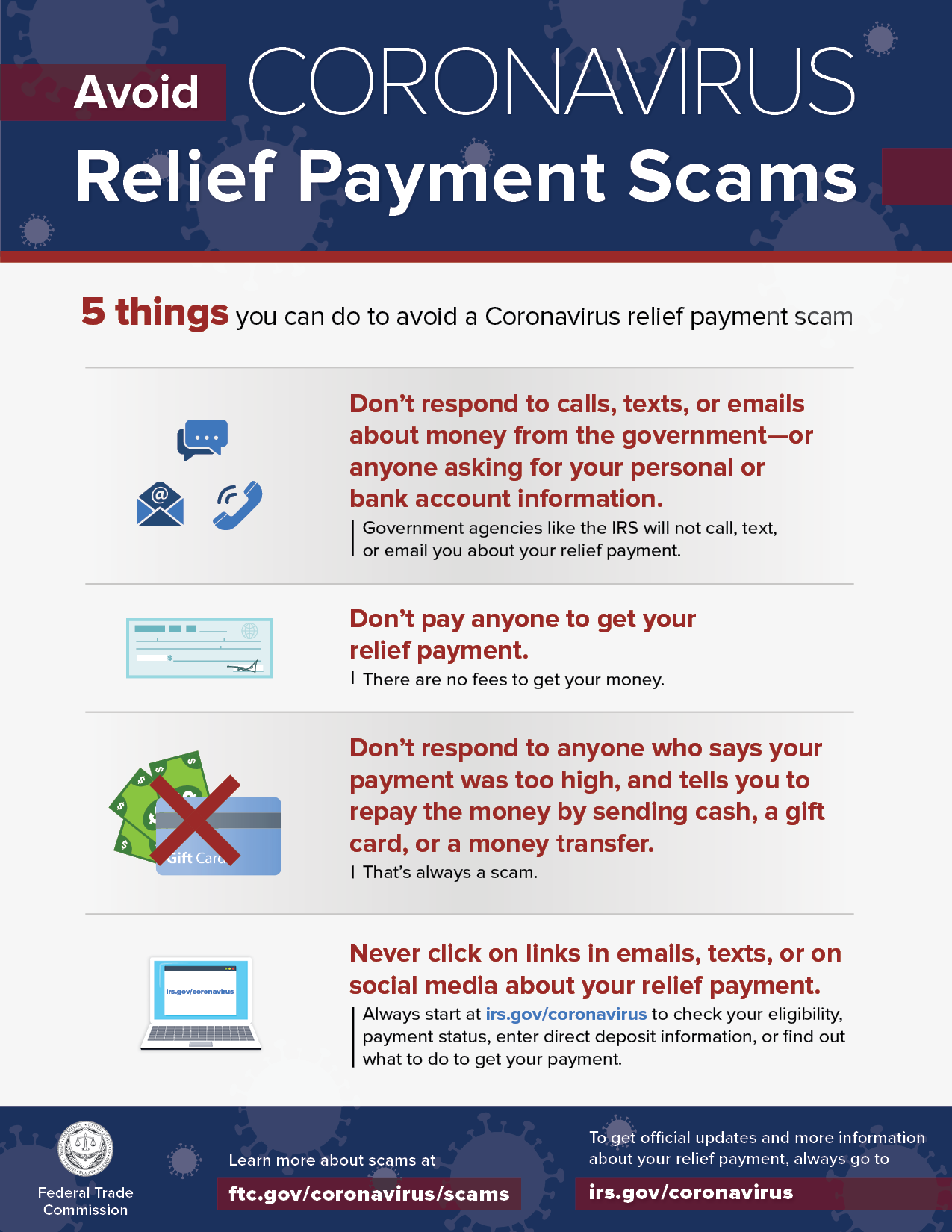

3 Ways To Avoid Irs Scams This Tax Season

What Happens If You Don T File Taxes Or Pay Your Bill By Tax Day

Where Is My Tax Refund Millions Of Americans Are Waiting For The Irs To Pay Up Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778395/Screen_Shot_2021_08_12_at_11.49.25_AM.png)

The Irs Has A Big Opportunity To Fix The Way Americans File Taxes Vox

Where S My Tax Refund Irs Reportedly Holding 30 Million Returns For Manual Processing Al Com

/cdn.vox-cdn.com/uploads/chorus_image/image/69720295/GettyImages_1332144820_copy.0.jpg)

The Irs Has A Big Opportunity To Fix The Way Americans File Taxes Vox

Inside Irs Operations To Handle Covid And The Filing Season Internal Revenue Service

Who Goes To Prison For Tax Evasion H R Block

Surprise No Tax Refund For You What Not To Do If You Owe The Irs The Washington Post

Us Billionaires Don T Pay Tax And Our Politicians Don T Seem Bothered Maureen Tkacik The Guardian

Biden Seeks 80 Billion To Beef Up I R S Audits Of High Earners The New York Times

Talking To Non Filers

Federal Government To Ask For Taxes On App Transactions Over 600

What To Know About Irs Unemployment Refunds Taxes Us News

The Irs May Owe You Interest On Your Tax Refund

Why The Irs Wants To Know About Your Crypto This Tax Season

Will Child Tax Credit Payments Affect Your 22 Taxes Here S What You Need To Know Cnet

I Don T Care Who The Irs Sends I Am Not Paying Taxes R Deltarune

Don T Fear The Tax Man Handling Irs Letters Notices Turbotax Tax Tips Videos

You Re Not The Only One Who S Not Paying Your Nanny Tax Wsj

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

Irs Mistakenly Sends Stimulus Checks To Foreign Workers Politico

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Getting Stimulus Payments To Homeless Communities Ftc Consumer Information

Us Citizens Living Abroad Do You Have To Pay Taxes

How To Pay Back Taxes You Owe To The Irs

Understanding Your Irs Notice Or Letter Internal Revenue Service

Aiden Been Watching Dan Vs And Honestly Zach Hazard And Mikeburnfire Are Literally Just Dan And Chris T Co Jzeiqmusyq Twitter

How To Claim Unemployment Tax Exemption In 21 Nextadvisor With Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778389/479264619.jpg)

The Irs Has A Big Opportunity To Fix The Way Americans File Taxes Vox

Child Tax Credit 21 How Much Do I Get When Do Monthly Payments Arrive And Other Faqs Kiplinger

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Tech Bro Influencer Claims He Makes Cash Snitching On Strippers To Irs Rolling Stone

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

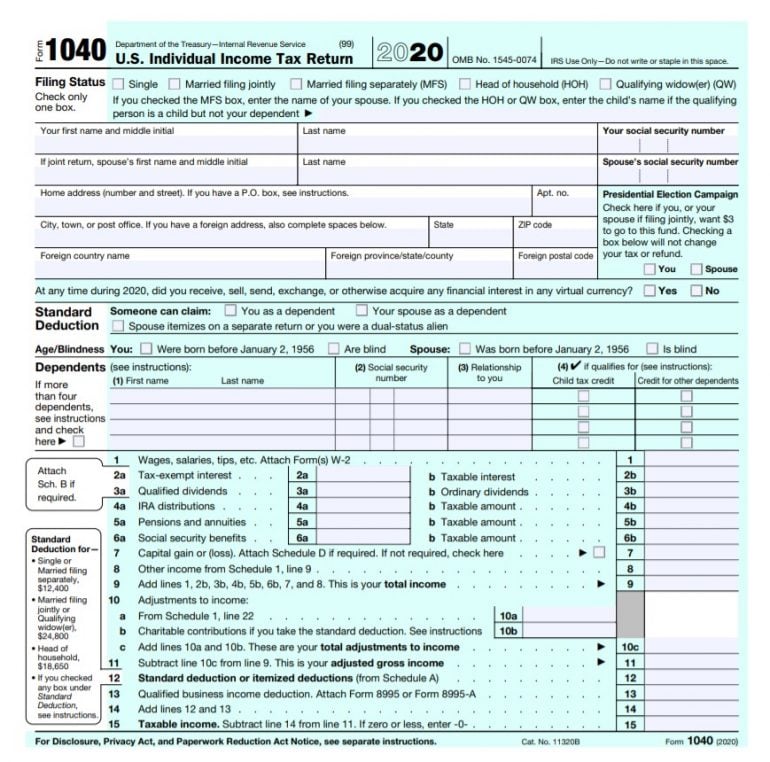

Irs Form 1040 Individual Income Tax Return 21 Nerdwallet

Do I Have To File Taxes The Answer Depends On Income Age Filing Status Bankrate Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Biden Seeks 80 Billion To Beef Up I R S Audits Of High Earners The New York Times

Publication 17 Your Federal Income Tax Internal Revenue Service

Faqs On Tax Returns And The Coronavirus

0 件のコメント:

コメントを投稿